Download or Auto-Sync 2A/2B Data

Overview: Cygnet facilitates the download and auto-sync of GSTR-2A/2B, for smooth and automated reconciliation.

Benefits: By auto-sync of GSTR-2A/2B data the system can perform the reconciliation on regular intervals and provides an accurate view for Accounts Payable.

How to Download or Auto-Sync GSTR-2A/2B data : To auto-sync 2A/2B user need to enable the auto-sync options from the company/location created on the system. To navigate to the functionality, user can go to Manage Organization> Entities >Actions> Auto-sync options.

User will now be able to view multiple Auto-sync options, from which they can select the option for syncing the data for GSTR-2A/2B and SAVE.

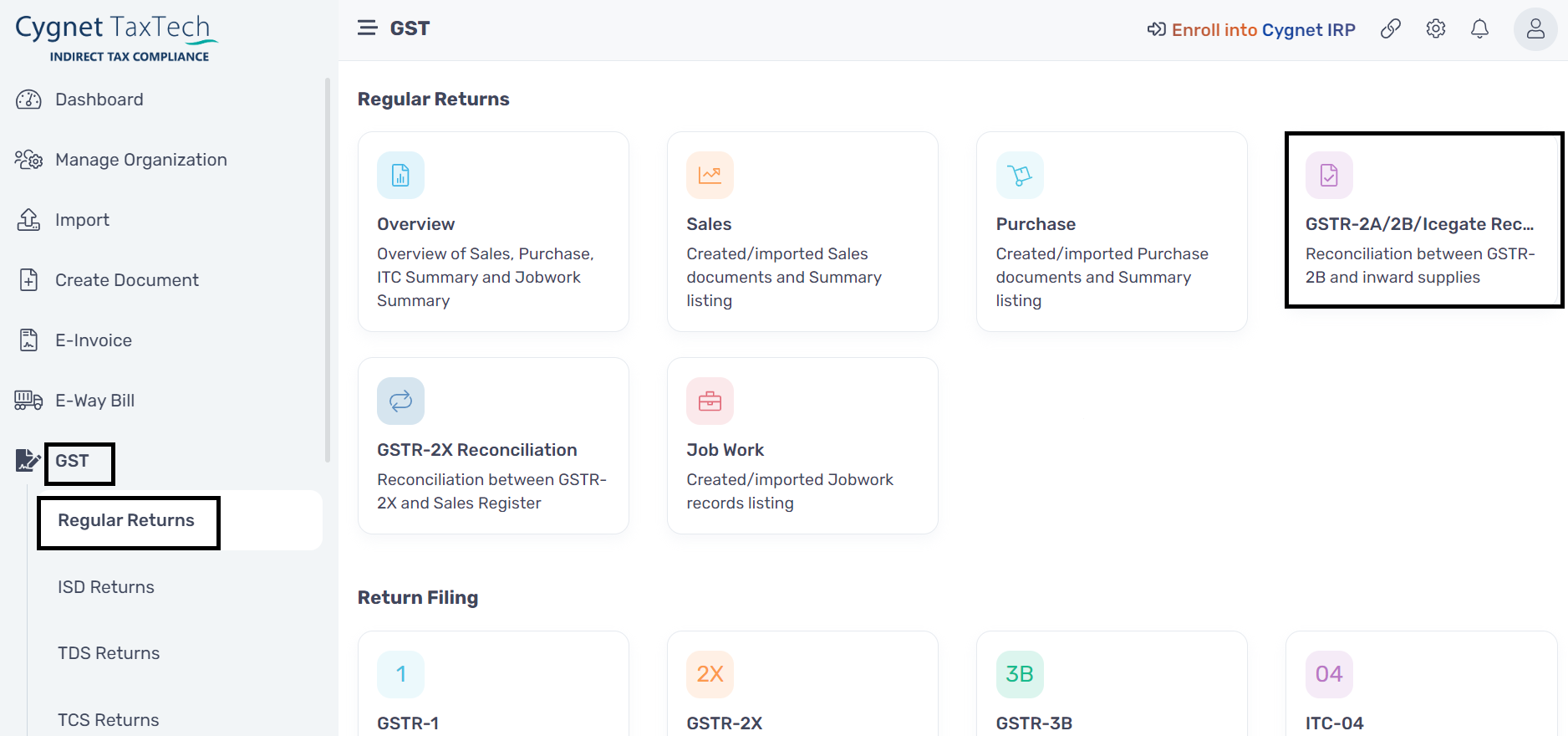

User can also download the data from Reconciliation screen. To do so, user need to navigate to GST > Regular Returns > GSTR-2A/2B/Icegate Recon.

User can click on Reconcliation Actions > Download GSTR-2A/2B from GST System.

Related Articles

Setting : Auto-sync Business Partner Master & Search Taxpayer

The provided setting doesn’t represent auto syncing of GSTIN data on regular basis, this setting will work on the below case. We receive Change List from GST on regular basis and we have also enabled a scheduler on hourly basis and whenever we ...Data Sync issue

Error Description:- GST session expired Resolution:- If you are getting this error than you need to guide the client for the resolution Step to correct the error:- While syncing the data if you encounter with the GST session(available in Entities ...Value auto-population in GSTR3B in section 4A(5) - all other ITC

As per circular 140, the auto-population of GSTR3B - Section 4A(5) - All other ITC can be verified using below calculation : Step 1 1.on Reconciliation screen, Select the Location, PR Return Period(Full PR range) & 2B Return Period(Full 2B range) & ...Download E-way Bill from NIC

Resolution: The user should verify whether the document is already in Generated, Cancelled, or Expired status. Steps to Correct the Error: If the document is not visible on the portal, it can be downloaded from the NIC portal by following the steps ...E way bill download from NIC

Description:- how to download E-way bill from NIC Resolution : The process can be done from the E-way bill section of cygnet portal Steps to correct the error : To download the E-way bill from NIC PORTAL by following the below steps login >>E-way ...