GSTR - 2A/2B/Icegate Reconciliation

Overview: GSTR-2A/GSTR-2B/Icegate reconciliation module helps user to reconcile their purchase data with counterparty data.

Benefits : Cygnet facilitates the AI based reconciliation which can help reconcile the invoices and claim rightful ITC.

How to do GSTR-2A/2B/Icegate reconciliation : To access to the reconciliation, user need to navigate to Menu > GST > Regular Returns > GSTR-2A/2B Reconciliation.

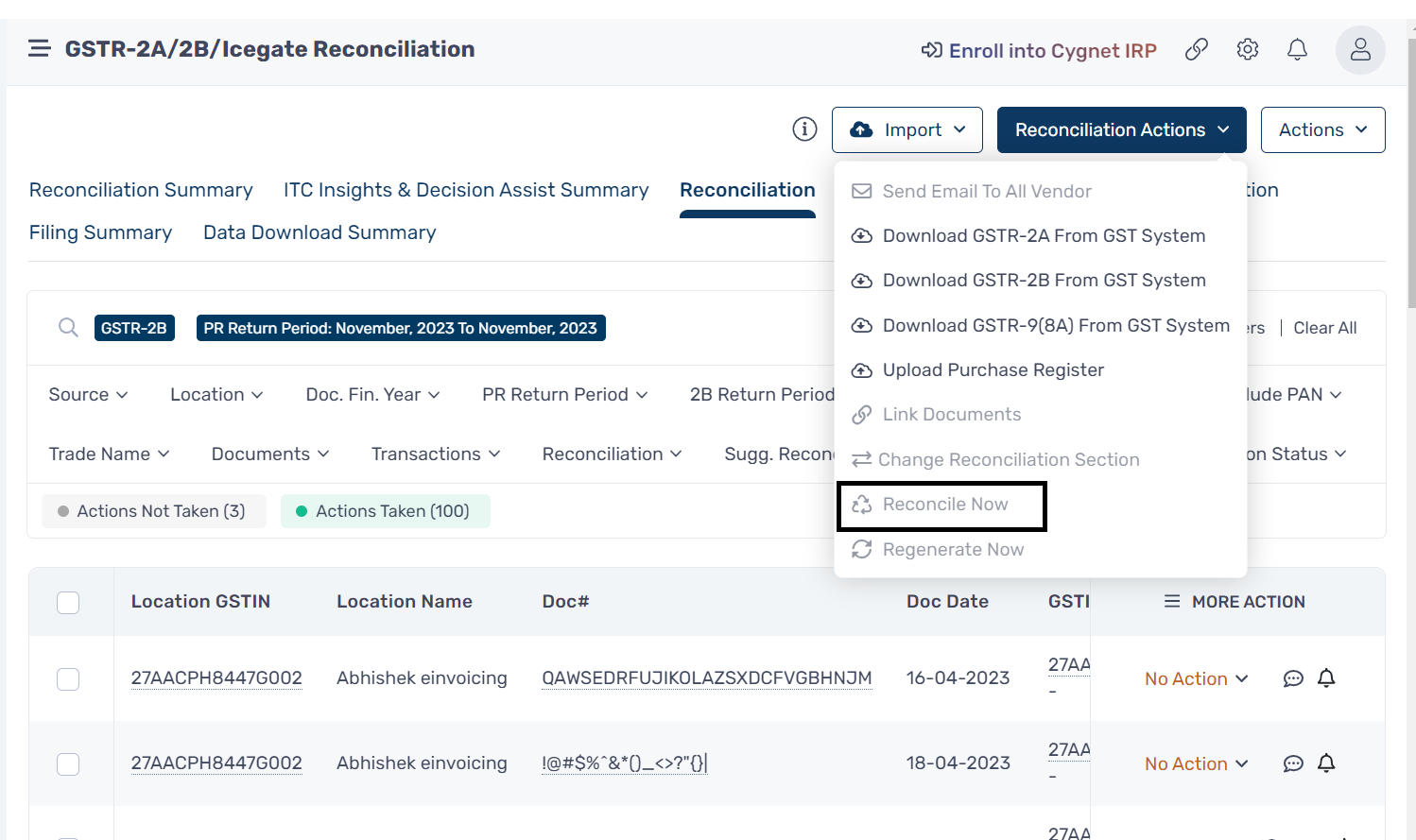

As the data is auto-synced from GSTN and Purchase register is uploaded , system can reconcile the data by clicking on Reconciliation Actions > Reconcile Now.

User need to select the source against which they want to reconcile their purchase records. User can filter for Source , Location , Return period for which they want to view the reconciliation.

System will reconcile the invoices based on the settings applied. Below are the different reconciliation buckets available.

A.

Matched: In this section all the GSTR-2A/2B transaction and uploaded purchase data is matching exactly and will be available in Matched action. It can be filtered from Reconciliations > Matched.

B.

Matched by Tolerance: Documents

will be considered as match by tolerance if difference in Document Value, Taxable

Value and Tax Amounts are within the specified range provided in settings.

C.

Mismatched: In this section, It identifies the mismatches between Purchase and GSTR-2A/2B after reconciliation. User will able to find the reason of mismatch in Reason field.

D.

Near Matched: Documents with all

the details matching with counterparty. However, the Document Number will be

intelligently identified using AI based reconciliation. There are 12 different buckets for identifying these mismatches and other 17 buckets mentioned as below.

Main reconciliation buckets are as follows :

1) Probable document # mismatch 1.I - 1.VII - Identifies the different types of document number mismatches between purchase register and counter party data.

2) Potential Document Date Mismatch : Identifies the document date mismatches between purchase register and counter party data.

3) Document Type Mismatch : This bucket provides the invoices having mismatch in document type but other parameters are exactly matching.

4) Supplier GSTIN Mismatch : It identifies the records having mismatch in GSTIN.However other parameters are exactly matching.

Other additional buckets includes the mismatches in :

a. Document number

b. Document date

c. Transaction type

d. POS

e. Reverse Charge

f. Rate

g. Taxable Value

h. Tax Amount

i. IRN

j. Cross Tax

k. Revised & Original Document

l. Wrong location

E.

PR Only: When the Purchaser has

uploaded all the purchase document, but the supplier/vendor has not filed the

sales data then such records fall into PR Only category.

F.

GST Only: When the Supplier has uploaded all the sales data, but the Purchaser has not booked the invoice in their purchase register will be available in GST only category.

G.PR Discarded: If the buyer has

amended the document, then original document with amended one will be matched

with amended document.

H. GST Discarded: If the supplier has amended the document, then original document with amended one will be

matched with Amended document.

User can take action against single invoices or bulk invoices after performing reconciliation. To take bulk action , user need to navigate to More Actions > Bulk Actions.

User can select the actions against reconciliation section and click on Apply Bulk Action.

To download the reconciliation user can click on Actions > Download Excel.

Related Articles

GSTR-6A Reconciliation

Overview: GSTR-6A/ISD is an auto-generated form that compiles information from the suppliers of an Input Service Distributor (ISD) as per their GSTR-1 filings. It is presented in a read-only format, meaning alterations can only be made during the ...GSTR-2X Reconciliation

Overview: GSTR 2X Reconciliation module helps in reconciliation the TDS and TCS credit received from your counterparty. Benefits : Cygnet facilitates reconciliation which can help reconcile the invoices and file GSTR-2X return. How to do GSTR-2X ...Not Able To Find GSTR 6A Documents In Reconciliation 6A

Error description:- Not able to find GSTR 6A documents In reconciliation 6A Resolution:- 1. Used need to check if GST session is active or not. If not user can navigate to Manage Organization > Entities and filter for the entity and click on Generate ...Vendor Reconciliation

Overview: Vendor reconciliation provides vendor-wise reconciliation , which provides an overall view of the documents raised by the vendor and status against the PR record. Benefits : Cygnet facilitates the AI based reconciliation which can help ...Manual Reconciliation

Overview: Manual reconciliation is designed to match many-to-many , one-to-many , many-to-one cases. It also provides an option to manually match the invoices from only available PR or only available in GST. To access to Manual Reconciliation : User ...