How to generate E-waybill by IRN/E-invoice

Note: To download the E-Way Bill by IRN, you must first generate the E-Invoice. The E-Way Bill can only be generated after the E-Invoice is successfully created.

Firstly, We have to generate the E-invoice

Firstly, We have to generate the E-invoice

Log in to the Cygnet Portal.

Go to the Documents section (second option on the top-left corner).

Enter the document number for which you want to generate the IRN.

Select the specific document from the list and navigate to the E-Invoice section.

Click on Generate IRN.

The IRN will be generated successfully.

Now to generate the E-way bill

Go to the E-Way Bill module and click on E-Way Bill.

Enter the document number for which you want to generate the E-Way Bill.

Select the specific document and click on E-Way Bill Action.

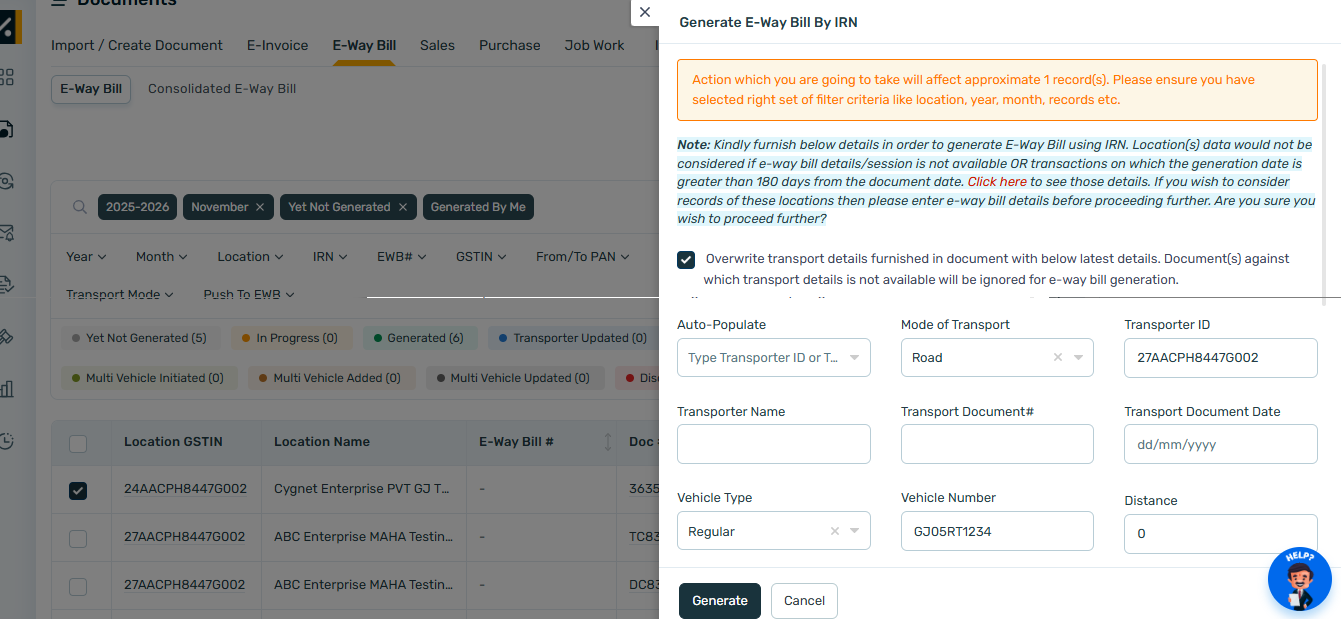

Choose Generate E-Way Bill by IRN.

A prompt will appear allowing you to override existing details or manually update transport details if required.

Click on Proceed with Generation.

The E-Way Bill will be generated successfully.

Related Articles

E-Invoice Generation , View and Print

Overview: E-Invoicing aims to replace traditional paper-based invoicing systems with more efficient and automated digital processes. It is required for compliance purpose. Key Benefits: E-Invoice automation brings time savings by streamlining the ...How can I check the generated E-invoice through IRN?

To view the generated E-invoice number using IRN, you can click on the respective IRN number after filtering out the “Generated” status. In order to view the document details, click on Document number, it will open the panel with all ...How to generate E-invoice for E-Commerce operator?

Steps: 1. Need to onboard E-Commerce operator on Cygnet vis registering them on E-Invoice portal as E-Commerce operator who can generate E-invoice on behalf of Seller. URL: e - Invoice System Go to: Registration > Portal Log in 2. Add GSTIN on Cygnet ...IRN Cancellation

E-Invoice Cancellation Steps 1. Purpose The purpose of this procedure is to outline the steps and guidelines for cancelling an issued Electronic Invoice (E-Invoice) in cases where errors are identified or a transaction is voided. This ensures ...E-Invoice API Enablement

Overview: E-Invoice API enablement is required for sending your transactions to IRP portal through API. Key Benefits: Enabling the E-Invoice API helps make the connection with IRP portal for sending the e-invoice data and generate IRN & QR code. How ...