Search Taxpayer

1. Search Taxpayer by PAN

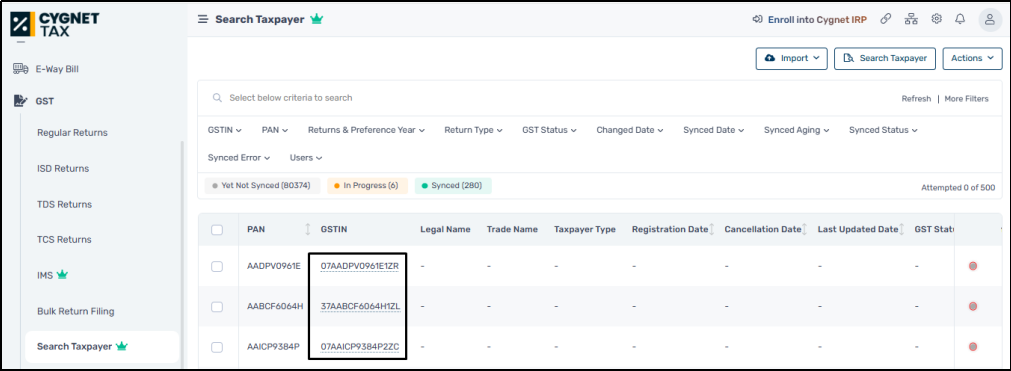

To access Search Taxpayer feature: User can navigate to GST > Search Taxpayer.

To search for taxpayers on the portal, users need to click on 'Search Taxpayers’.

After clicking on Search Taxpayer, select the details from Search GSTIN, Preference, and Returns. Then, enter the PAN for which you wish to search details in the box shown in the image below. Then, click on Search.

To import the data in bulk, users can import the file by clicking on Import.

Import

1 To import the data in bulk, users can import the file by clicking on Import.

2 Users would be importing Sales Documents through Import module from Import -> Import -> GSTIN/PAN (Search, Preferences & Return Filing)

1 Users need to select the GSTIN/PAN (Search, Preferences & Return Filing) Import type for importing bulk data.

2 Clicking on the Import Type, import pop up would be displayed on the screen as per the screen below shot.

4 Users need to import excel format here.

5 Users would be able to browse as well as Drag and Drop file here.

6 Clicking on the Import button, file would be imported successfully if there is not any validation in file and if there is any validation in imported file then file would be displayed with File status icon on the screen.

7 Clicking on Cancel button, import pop up would be closed.

8 Status of the records would be as per below.

a. Success

b. Error

c. Orphan

If records are uploaded successfully then those records would count in Success, if records are uploaded with any validation, then those records count would count in Error/Orphan as per validation.

Users will be able to view the details of successfully fetched data of taxpayers on the listing screen. It includes details such as PAN, GSTIN, Tradename, Legalname, Taxpayer Type, Registration Date, Cancellation Date, GST status and other details.

To view the detailed status of GSTIN, you can click on GSTIN. User will be able to view the GSTIN status , return filling preference, return filling details and GRC score.

2. Search/view and Track Returns

To view vendor details, click on “GSTIN”

To track return, click on “Return filing details”

Related Articles

Search Taxpayer for cygnet IRP

1.1. Taxpayer: Taxpayer functionality will provide with the basic details of GSTIN. Navigation: Go to Home >> Search >> Taxpayer >> Enter the GSTIN - Search Taxpayer will get the below shown details for searched GSTIN. 1.1. E-invoice Enablement ...Setting : Auto-sync Business Partner Master & Search Taxpayer

The provided setting doesn’t represent auto syncing of GSTIN data on regular basis, this setting will work on the below case. We receive Change List from GST on regular basis and we have also enabled a scheduler on hourly basis and whenever we ...SEZ error for transaction ?

Steps: we can check whether the user is a regular taxpayer or not because for SEZ the taxpayer should be always SEZ as the same. As the error is that the Recipient is in SEZ zone and you have entered regular B2B transaction. Kindly enter the ...E-wayBill will not be generated for blocked user

· Blocking of e-waybill generation means not allowing the taxpayer to generate e-waybills if he /she has not filed GST Return for latest two successive months or quarters. The blocked GSTIN cannot be used to generate the e-way bills either as ...Cygnet IRP API

Below are contents that can be accessed under API section of Cygnet IRP homepage. 1. Specifications 2. Overview and Benefit 3. Pre-Requisites 4. Credentials 5. Best Practices 6. Version Management 7. Error Codes list Home > API > Specifications: API ...