Verify and File GSTR-3B

Overview: The Cygnet Portal simplifies GSTR-3B preparation by automatically populating the summary values in the form and providing user to verify and file the return. .

Benefits: By compiling transaction-level data from GSTR-1 , 2B and 2 data , system auto-populates the summary values in respective sections of GSTR-3B. This streamlines the verification process for users, enabling quick and accurate filling of GSTR-3B return.

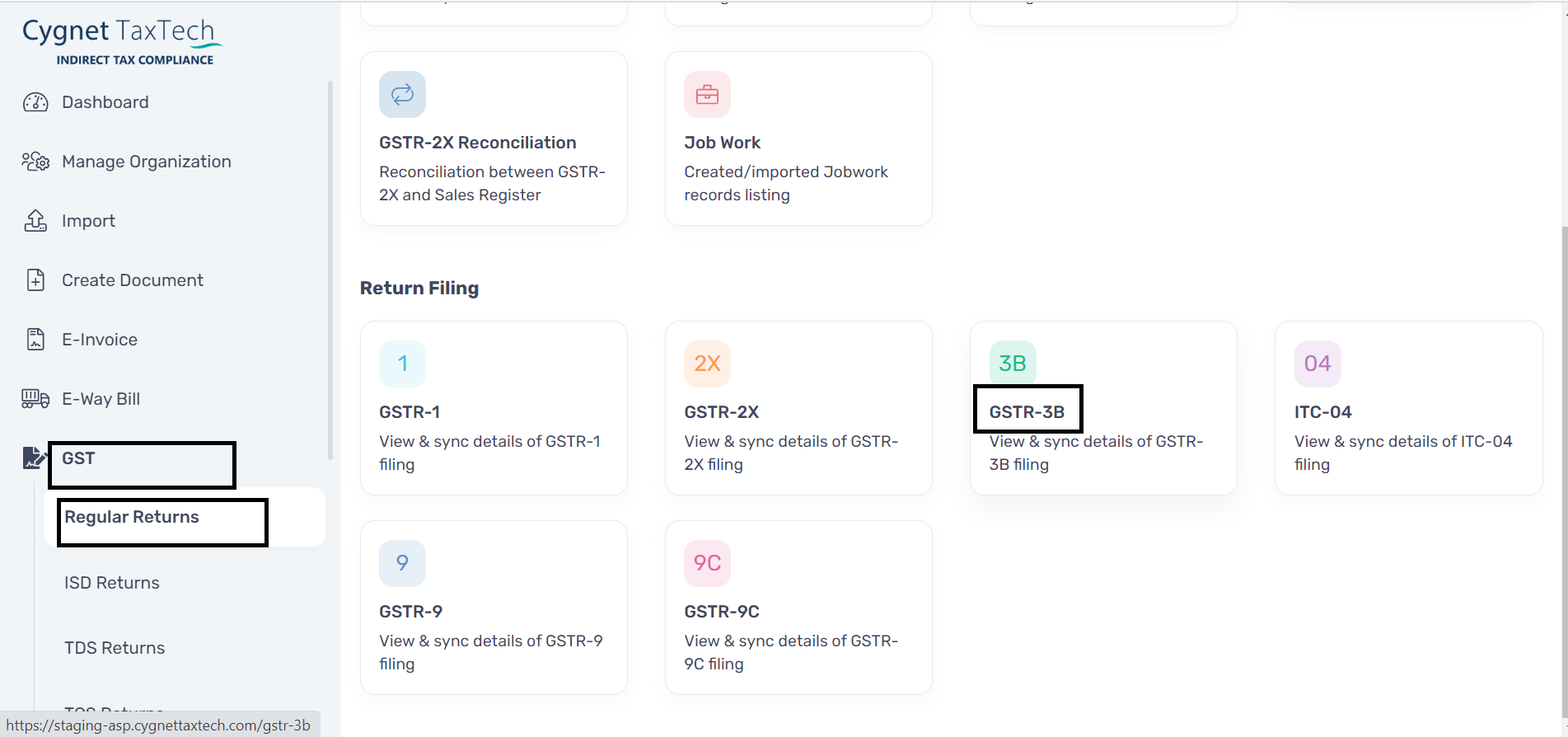

How to auto-populate the data and file GSTR-3B Return : User need navigate to Dashboard > GST > Regular Returns > GSTR-3B.

User can select the Year, Month , Location and Auto-populate on options from the filter. Cygnet provides three different options such as System , GST System(GSTR-1 Auto-liab + GSTR-2B Auto-itc) & GST System(GSTR-1 Auto-liab + GSTR-2B Excluding Claimed-itc).

Related Articles

GSTR-2X Return

Overview : GSTR 2X is an auto-populated return form that needs to be filed by a taxpayer who wants to claim for TDS and TCS credit received. Benefits: By seamlessly populating the data in the necessary sections of the GSTR-2X form, the system ...GSTR-6A Reconciliation

Overview: GSTR-6A/ISD is an auto-generated form that compiles information from the suppliers of an Input Service Distributor (ISD) as per their GSTR-1 filings. It is presented in a read-only format, meaning alterations can only be made during the ...File ITC-04

Overview: The Cygnet Portal streamlines ITC-04 preparation by automatically populating the data to relevant sections of ITC-04, simplifying the process. Benefits: By seamlessly populating the data in the necessary sections of the ITC-04 form, the ...GSTR-1 Verification and Filing through Cygnet Portal

1. Objective The objective of this procedure is to guide users through the process of verifying and filing their GSTR-1 returns using the Cygnet Portal. The portal simplifies the GSTR-1 preparation process by automatically populating relevant data ...GSTR-2X Reconciliation

Overview: GSTR 2X Reconciliation module helps in reconciliation the TDS and TCS credit received from your counterparty. Benefits : Cygnet facilitates reconciliation which can help reconcile the invoices and file GSTR-2X return. How to do GSTR-2X ...